The essential elements of Forex trading, from understanding currency pairs to advanced strategies. Learn how to effectively trade in the world’s largest financial market and manage the associated risks with confidence.

Forex trading, also known as foreign exchange trading, involves the exchange of currencies in a decentralised global market. Unlike traditional stock markets, forex trading takes place over-the-counter (OTC) with no central exchange. The forex market operates 24 hours a day, five days a week, offering unparalleled flexibility to traders around the world. This constant operation allows traders to react swiftly to global events, economic data releases, and geopolitical developments, making it one of the most dynamic financial markets.

With the UAE, especially Dubai and Abu Dhabi, emerging as global hubs for fintech innovation, traders in the region are increasingly embracing automated and algorithmic solutions to stay competitive in today’s fast-paced forex markets.

The forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This massive volume not only provides liquidity but also presents countless trading opportunities. Forex trading is accessible to a wide range of participants, from individual retail traders to large financial institutions. Its accessibility, combined with the potential for profit in both rising and falling markets, makes forex trading a popular choice among traders.

The forex market is driven by various participants, each playing a crucial role in its operation. These participants include:

Currencies are traded in pairs, meaning the value of one currency is relative to another. The most traded currency pairs are known as Major Pairs, which include the US Dollar paired with other major currencies, such as the Euro (EUR/USD), British Pound (GBP/USD), and Japanese Yen (USD/JPY). These pairs are popular due to their high liquidity and tight spreads.

These pairs do not include the US Dollar but involve other major currencies, such as EUR/GBP or GBP/JPY. While still liquid, minor pairs often have wider spreads than major pairs.

Exotic pairs consist of a major currency paired with a currency from an emerging or smaller economy, such as USD/TRY (US Dollar/Turkish Lira) or EUR/SEK (Euro/Swedish Krona). These pairs tend to have higher volatility and wider spreads.

Leverage is a double-edged sword in forex trading. It allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses. For example, with a leverage ratio of 100:1, a trader can control a $100,000 position with just $1,000. However, this also means that a small adverse movement in the market can lead to significant losses.

Margin is the amount of money required to open a leveraged position. It acts as collateral for the trade. Understanding how to manage margin and leverage is crucial for maintaining a healthy trading account and avoiding margin calls, where the broker requires additional funds to keep positions open.

A pip (percentage in point) is the smallest price movement in a currency pair, typically 0.0001 for most major pairs. Pips are used to measure price changes and calculate potential profits or losses.

Forex is traded in lots, which represent the size of a trade. A standard lot is 100,000 units of the base currency, but smaller lot sizes are available, such as mini lots (10,000 units) and micro lots (1,000 units), making forex trading accessible to different levels of traders.

The spread is the difference between the bid (buy) and ask (sell) prices of a currency pair. It represents the cost of trading, with tighter spreads being more cost-effective for traders. Spreads can widen during periods of high volatility or low liquidity.

Technical analysis is the study of historical price movements and patterns to forecast future price movements. It is a fundamental approach in forex trading, relying heavily on charts and technical indicators. Key technical analysis tools include:

Moving averages smooth out price data to create a trend-following indicator. The most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA). Traders use them to identify trends and potential entry or exit points.

Bollinger Bands consist of a moving average and two standard deviation lines. They help traders identify overbought or oversold conditions and potential price reversals.

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought (above 70) or oversold (below 30) conditions.

This indicator compares a particular closing price of a currency pair to a range of its prices over a certain period. It is used to generate overbought and oversold signals, helping traders anticipate potential market reversals.

Fundamental analysis involves evaluating economic data, news events, and geopolitical developments to assess their impact on currency values. Key factors include:

Central banks use interest rates to control inflation and influence economic activity. Higher interest rates attract foreign capital, leading to currency appreciation, while lower rates may result in currency depreciation.

Indicators such as Gross Domestic Product (GDP), employment rates, and inflation data provide insights into a country’s economic health. Positive data typically strengthens a currency, while negative data can weaken it.

Political instability, elections, trade disputes, and natural disasters can all affect currency values. Traders must stay informed about global events that could impact the forex market.

Successful forex trading requires the development and application of well-thought-out strategies. Some of the most popular strategies include:

Scalping involves making multiple trades throughout the day to capture small price movements. Scalpers rely on high leverage and tight spreads to make quick profits, often holding positions for just seconds or minutes.

Day traders open and close positions within the same trading day, avoiding overnight risk. They focus on short-term price movements and use technical analysis to identify trading opportunities.

Swing traders aim to capture price swings in the market by holding positions for several days or weeks. This strategy requires patience and a solid understanding of technical and fundamental analysis.

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This approach is based on macroeconomic trends and requires a deep understanding of the fundamental factors driving the market.

The carry trade strategy involves borrowing funds in a currency with a low-interest rate and investing in a currency with a higher interest rate. The profit comes from the interest rate differential, but the strategy also carries currency risk.

The forex market’s 24-hour operation is one of its most significant advantages. Unlike stock markets, which have set trading hours, the forex market allows traders to trade continuously from Monday to Friday. This is possible because trading sessions overlap across different regions, including Asia, Europe, and North America. Traders can choose to trade during the most active sessions, such as the London-New York overlap, to take advantage of higher liquidity and tighter spreads.

Forex trading is known for its high liquidity, particularly in major currency pairs. High liquidity ensures that traders can enter and exit positions quickly without significant price fluctuations. This liquidity is especially important for large institutional traders who need to execute sizable orders without moving the market.

Volatility, while often viewed as a risk, also presents opportunities for profit. The forex market’s volatility is driven by various factors, including economic data releases, geopolitical events, and market sentiment. Traders who can effectively manage volatility can benefit from substantial price movements.

Forex trading offers the flexibility to profit in both rising and falling markets. Unlike the stock market, where investors typically buy and hold assets in anticipation of price appreciation, forex traders can go long (buy) or short (sell) depending on their market outlook. This ability to trade in both directions provides more opportunities for profit, regardless of the overall market trend.

Compared to other financial markets, forex trading generally has lower transaction costs. This is particularly true for major currency pairs, where spreads are usually tight due to high liquidity. Lower transaction costs make forex trading more accessible to a broader range of participants, from retail traders to large financial institutions.

While volatility creates trading opportunities, it also increases the risk of sudden price movements that can lead to losses. Traders must develop strategies to manage and mitigate these risks effectively. Some risk management techniques include:

A stop-loss order automatically closes a position when the price reaches a predetermined level, limiting potential losses.

Proper position sizing involves calculating the appropriate amount of capital to risk on each trade based on the trader’s risk tolerance and the size of their trading account.

Diversifying across different currency pairs or asset classes can help spread risk and reduce the impact of adverse price movements in a single market.

Leverage amplifies both potential profits and losses. While it allows traders to control larger positions with less capital, excessive leverage can quickly deplete a trading account in the event of a loss. To avoid the dangers of over-leverage, traders should:

Reducing the leverage ratio can help manage risk more effectively. Many experienced traders use leverage ratios of 10:1 or lower.

Setting clear risk management rules, such as limiting the percentage of capital risked on each trade, can help protect against significant losses.

Economic events and data releases can have a profound impact on currency prices. Traders must stay informed about key events, such as central bank meetings, employment reports, and GDP releases, that can influence market sentiment and cause sharp price movements. Understanding the timing and potential impact of these events is essential for managing risk and making informed trading decisions.

Forex trading is not only a test of analytical skills but also a psychological challenge. Traders must manage their emotions, such as fear and greed, which can lead to impulsive decisions and costly mistakes. Developing discipline and sticking to a well-defined trading plan are crucial for long-term success. Some psychological challenges include:

The temptation to trade frequently in the hope of making quick profits can lead to overtrading, which increases transaction costs and risk.

After a losing trade, some traders may attempt to recover losses by taking on more risk, often leading to further losses.

The fear of missing out on potential profits can lead to hasty decisions and poor trade execution.

MetaTrader platforms, particularly MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are among the most popular forex trading platforms globally. They offer a wide range of features, including:

cTrader is known for its user-friendly interface and advanced trading features. It is particularly popular among traders who require:

TradingView is a cloud-based platform that offers powerful charting tools and social trading features. It is widely used for its:

Developed by TD Ameritrade, Thinkorswim is a sophisticated trading platform offering:

As part of our expansion into the UAE region, Algo Forest is proud to have been invited by the Abu Dhabi Investment Office (ADIO), a recognition of our growing presence in the AI and fintech sectors.

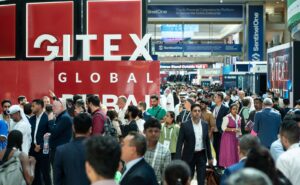

We’re also excited to announce that we will be exhibiting at GITEX Global 2024, happening at the Dubai World Trade Centre from October 14–18, 2024. Our team will be showcasing our latest AI-powered algorithmic trading solutions, aimed at empowering traders with cutting-edge automation, advanced analytics, and real-time strategies.

This milestone aligns with our broader mission to make algorithmic trading accessible to everyone in the UAE, equipping traders with the tools and education needed to succeed in one of the world’s most dynamic markets.

Forex trading offers a wealth of opportunities for those willing to invest time in learning and mastering the market. By understanding the core concepts, developing effective strategies, and managing risks diligently, traders can navigate the complexities of the forex market and work towards achieving their financial goals. Whether you are a beginner or an experienced trader, continuous education, discipline, and a well-defined trading plan are key to long-term success in forex trading.

If you're in the UAE and interested in transforming your trading approach, we invite you to connect with us at GITEX Global 2024 or begin your journey online from anywhere.

Visit AlgoForest.com to explore our online algorithmic trading courses and learn how automation and AI can elevate your trading performance.

Forex trading can be suitable for beginners, but it requires a commitment to learning and risk management. New traders should start by:

The best times to trade forex are during periods of high market activity, particularly when trading sessions overlap. For example:

The amount of capital needed to start trading forex depends on the trader’s goals, risk tolerance, and the broker’s requirements. While some brokers allow trading with as little as $100, it is recommended to start with a larger amount, such as $1,000 to $5,000, to effectively manage risk and accommodate potential losses.

No trading strategy can guarantee success in forex trading. The forex market is inherently unpredictable, and even the most well-developed strategies can lead to losses. Success in forex trading requires a combination of:

Risk management is crucial in forex trading. Some key risk management practices include:

Algorithmic trading once reserved for elite hedge funds and Wall Street quants is now going...

LEARN MORE >>Invited to landmark meeting with Abu Dhabi Investment Office, as its Forex Forest ecosystem empowers...

LEARN MORE >>外汇小课堂:外汇交易如何运作︖了解外汇交易的基本原理 外汇交易作为全球交易量最大、流动性最高的金融市场之一,每天的交易总额高达 6.6 兆美元,吸引了无数投资者参与。然而,对于许多外汇新手来说,外汇到底是怎么运作的?是否真的如传说中那般高风险、难以掌握? 本文将带您逐步了解外汇市场的基本架构和操作方式,帮您扫清学习过程中的疑惑。不论您是初学者还是稍有经验的交易者,都可以从本文中获得实用的信息与策略。 外汇交易的基本原理是什麼︖ 外汇交易的核心是「以一种货币兑换另一种货币」,也就是所谓的「货币对」。例如 EUR/USD(欧元/美元)代表购买一欧元所需的美元数。 每种货币都有其标准缩写,例如 EUR 是欧元、USD 是美元。通过查看这些货币对的价格,交易者可以判断当前汇率,并作出买入或卖出的决策。 外汇价格由市场供需决定,全天候波动,因此也为交易者提供了众多机会。 📌 实用小贴士:可通过连接至权威外汇网站查看实时汇率。...

LEARN MORE >>